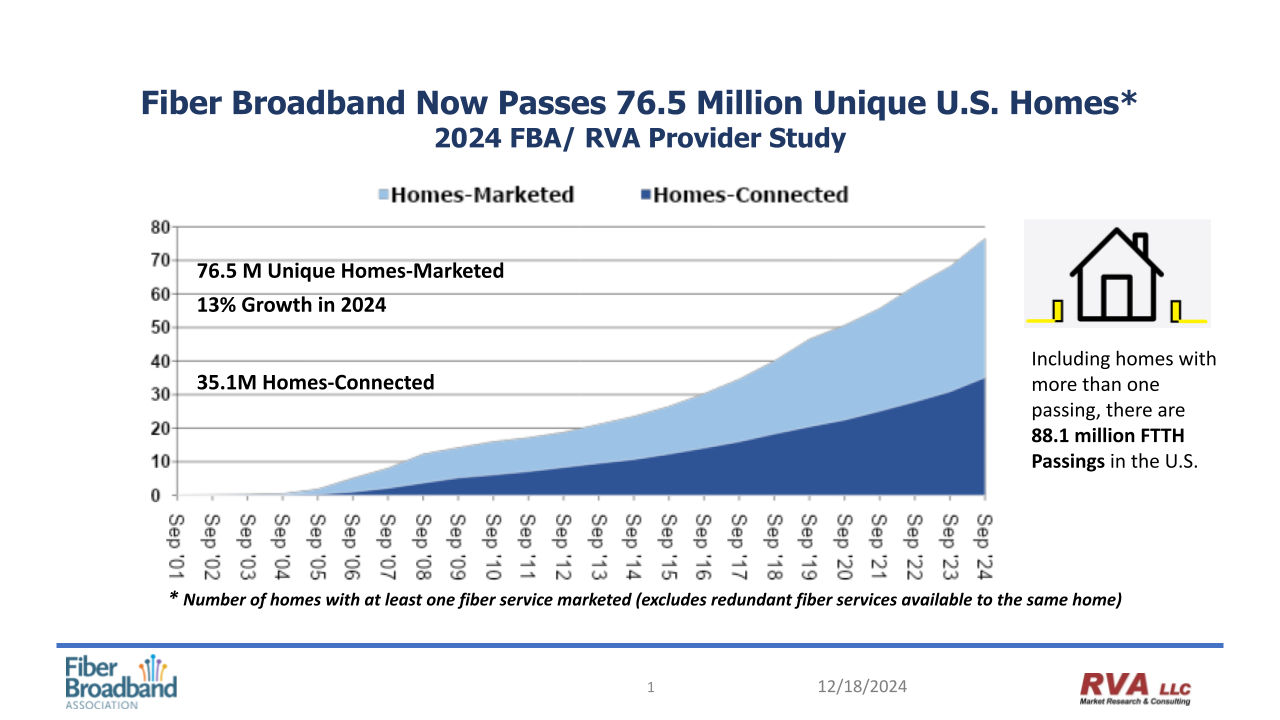

U.S. Home Fiber Deployments Top 88M homes passed

The most recent North American Fiber Deployment Report by RVA LLC Market Research & Consulting (RVA) released in January 2025 presented more records for the progress of fiber across America. A new annual record of 10.3 million U.S. homes were passed in 2024. Including homes with more than one passing, there are now a total of 88.1 million homes passed with fiber in the U.S., with continued growth expected over the next five years.

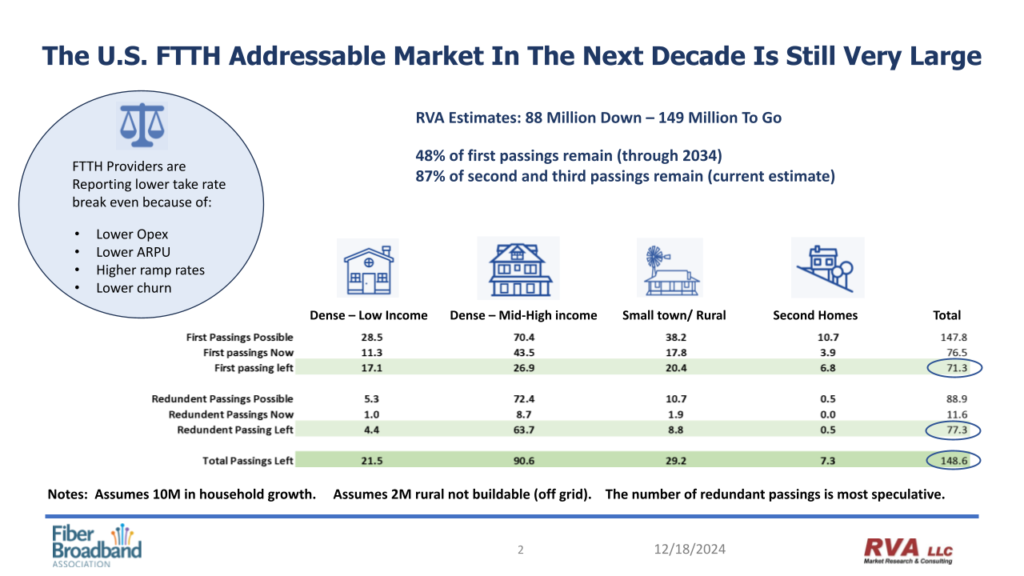

“The fiber broadband industry is experiencing record-breaking success, and there is a lot more runway left to go,” said Mike Render, Founder and CEO, RVA, in a January 23, 2025, FBA press release announcing the latest statistics. “The addressable FTTH (Fiber-to-the-Home) market remaining is still very large, assuming about 70 million first passings left (including household growth) and an estimated 80 million more second or third FTTH passings to go. That’s a total available market of 150 million FTTH passing left to go.”

Fiber now passes 56.5% of U.S. households, according to the 2024 survey data, with fiber take-rates increasing slightly in 2024, growing to an average of over 45% based on unique passings. Service providers are now achieving their first 20% take rate in a much faster period now and are reaching higher take rates over time. In addition, RVA estimates around 35.1 million U.S. homes were connected with fiber in 2024.

RVA’s deployment study methodology used multiple data sources to arrive at its numbers, including an analysis of public company data, 2024 FBA/RVA surveys of smaller to mid-sized providers, data from the 2024 FBA/RVA Consumer Study conducted in the first half of 2024, a review of 2024 FCC mapping data and other government sources, data from other industry associations, and interviews and data from vendors and engineers.

Render declared the fiber industry’s inventory issues generated by COVID-era stockpiling now resolved in a December 18, 2024, Fiber For Breakfast podcast discussing the report’s preliminary findings, with the average month of inventory estimates steadily going down across a six month period and those trends expected to continue into 2025, especially given the anticipated construction boom over the next five years.

A Bright Future

RVA estimates there are at least 150 million or more U.S. home fiber passings that can be done over the next decade, with 48% of first household passings remaining and an estimate of 87% of homes that could be passed two or three times in competitive markets. The RVA long-term estimate also assumes 10 million new homes will be added in the years to come.

“Looking at the addressable market, there’s still a lot of market left,” said Render on the December podcast. “First, households increase every year. The next decade we’re looking at a conservative one million households increase per year. There’s still a lot of initial passings out there [to be made], both in the dense low-income area, denser high-income aeras, small towns, rural, and of course, second homes… it may be as much as 150 million or more still.”

RVA does not believe that the arrival of DOCSIS 4.0 will stop cable’s continued market share decline in the marketplace. Instead, cable companies are embracing fiber to simplify their operational costs rather than trying to further upgrade their legacy coax plant and to stem churn losses from customers moving to fiber or fixed wireless. Cable has lost 33% net user share over the past two years, according to the FBA/RVA Consumer Study published in April 2024, compared to a 41% net gain for fiber providers during the same time in areas that cable and fiber are available.

There is a lot of money flowing into the telecommunications market from multiple sources, reports RVA, with S&P Global estimating private equity has committed about $80 billion cumulatively to telecom projects in the past five years, with disbursements of the money occurring over multiple years. Fiber mergers and acquisitions are on the rise, with deployment funding often increasing to accelerate the growth of market footprints. In the past year, T-Mobile has been investing in fiber as a supplement to their wireless holdings, while Canadian companies such as Cogeco and Bell Canada are investing in U.S. fiber operations.

Large U.S. telecom firms have reported an average of $96 billion capital investment annually in each of the past two years, with much of the funds going into fiber for competitive reasons and to replace legacy copper plant. Adjusted for inflation, this is almost double the capex investment for the previous 20 years. AT&T and Verizon have both indicated they are increasing capex, with AT&T planning to start copper retirement at 25 percent of its wire centers this year. AT&T would like to decommission most of its existing legacy copper plant by 2029, with 90 percent of the legacy copper footprint eventually getting fiber.

Finally, there are ongoing federal contributions to modernizing telecommunications infrastructure in unserved and underserved areas. The Federal Communications Commission (FCC) reported $64 billion cumulative in federal dollars over the past five years, from that agency, U.S. Department of Agriculture Rural Utility Service (RUS), NTIA and U.S. Treasury funding, with much of that going into fiber networks. Over the next five years, the $42.5 billion in NTIA BEAD funding is expected to be awarded, with disbursements occurring over multiple years, plus additional funding likely from FCC and USDA RUS programs.

Because of these factors, RVA’s five-year U.S. FTTH forecast is quite strong. The firm expects a 50% or more increase in homes passed when two or more fiber passings are included, and over a 100% increase in route miles added to support homes passed, with the only constraint to growth being workforce availability.

Once the FTTH market reaches maturity, RVA anticipates plenty of growth opportunities in numerous other markets, as other fiber use cases are relatively early in their evolution. Fiber to the data center (FTTD) is likely to be very strong as AI and data centers continue their growth, while fiber to the tower (FTTD) and middle mile will continue as cellular coverage expands within and outside of urban areas. Smart grid applications combining renewable energy generation, storage, and microgrids, especially when managing EV chargers and vehicles, require fiber for real-time resource management.

A bit further out, fiber’s opportunities become more mundane and more exotic. Fiber to the room, extending high-speed coverage within the office and room is a logical step, especially as higher-speed wireless services depend on line-of-sight access. Fiber will also play a growing role in quantum computing applications, autonomous vehicles, and used as a sensor medium to monitor environmental and building conditions. The plethora of fiber applications in other markets is likely to keep the fiber ecosystem strong and thriving for years to come.